Some Known Factual Statements About Eb5 Investment Immigration

Some Known Factual Statements About Eb5 Investment Immigration

Blog Article

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

Table of ContentsAn Unbiased View of Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You Get ThisGetting My Eb5 Investment Immigration To WorkA Biased View of Eb5 Investment ImmigrationThe 4-Minute Rule for Eb5 Investment Immigration

While we make every effort to offer precise and updated web content, it should not be taken into consideration lawful suggestions. Immigration regulations and laws go through alter, and individual circumstances can differ widely. For personalized advice and lawful advice regarding your details migration circumstance, we strongly recommend seeking advice from a qualified migration lawyer that can give you with tailored assistance and ensure conformity with existing legislations and laws.

Citizenship, through financial investment. Presently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Areas and Country Areas) and $1,050,000 somewhere else (non-TEA areas). Congress has approved these amounts for the following five years starting March 15, 2022.

To get the EB-5 Visa, Capitalists need to develop 10 full-time U.S. jobs within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Need makes sure that financial investments contribute directly to the united state task market. This applies whether the jobs are produced directly by the company or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

Eb5 Investment Immigration - Questions

These tasks are figured out through designs that utilize inputs such as growth prices (e.g., building and tools expenses) or annual profits produced by recurring operations. In comparison, under the standalone, or straight, EB-5 Program, just direct, permanent W-2 staff member settings within the business might be counted. A key danger of depending exclusively on direct staff members is that staff decreases due to market problems could cause inadequate full-time positions, possibly causing USCIS denial of the investor's application if the job creation need is not fulfilled.

The financial version then forecasts the number of straight tasks the brand-new company is likely to create based on its awaited earnings. Indirect work calculated through economic models refers to work created in markets that provide the items or services to the service directly involved in the project. These tasks are developed as a result of the raised need for products, products, or solutions that sustain business's procedures.

Some Of Eb5 Investment Immigration

An employment-based 5th preference category (EB-5) financial investment visa supplies a method of coming to be a long-term united state homeowner for international nationals wanting to invest resources in the USA. In order to get this permit, an international financier must invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Location") and produce or preserve at the very least 10 full time jobs for United States workers (excluding the investor and their prompt family members).

This procedure has been an incredible success. Today, 95% of all EB-5 funding is raised and spent by Regional Centers. Because the 2008 financial situation, access to resources has actually been constricted and municipal budget plans remain to deal with considerable shortfalls. In many regions, EB-5 financial investments have filled up the financing gap, giving a new, crucial resource of capital for neighborhood financial development tasks that rejuvenate neighborhoods, produce and support work, facilities, and solutions.

Eb5 Investment Immigration - An Overview

employees. In addition, the Congressional Budget Workplace (CBO) racked up the program as revenue neutral, with administrative costs paid for by candidate costs. EB5 Investment Immigration. Even more than 25 countries, including Australia and the UK, use similar programs to bring in foreign financial investments. The American program is much more stringent than many others, calling for significant danger for financiers in regards to both their monetary investment and immigration standing.

Families and individuals who seek to relocate to the United States on a long-term basis can obtain the EB-5 Immigrant Financier Program. The USA Citizenship and Immigration Solutions (U.S.C.I.S.) laid out different requirements to acquire long-term residency with the EB-5 visa program. The demands can be summed up as: The financier needs to fulfill capital expense quantity needs; it is typically required to make either a $800,000 or $1,050,000 capital expense amount right into an U.S.

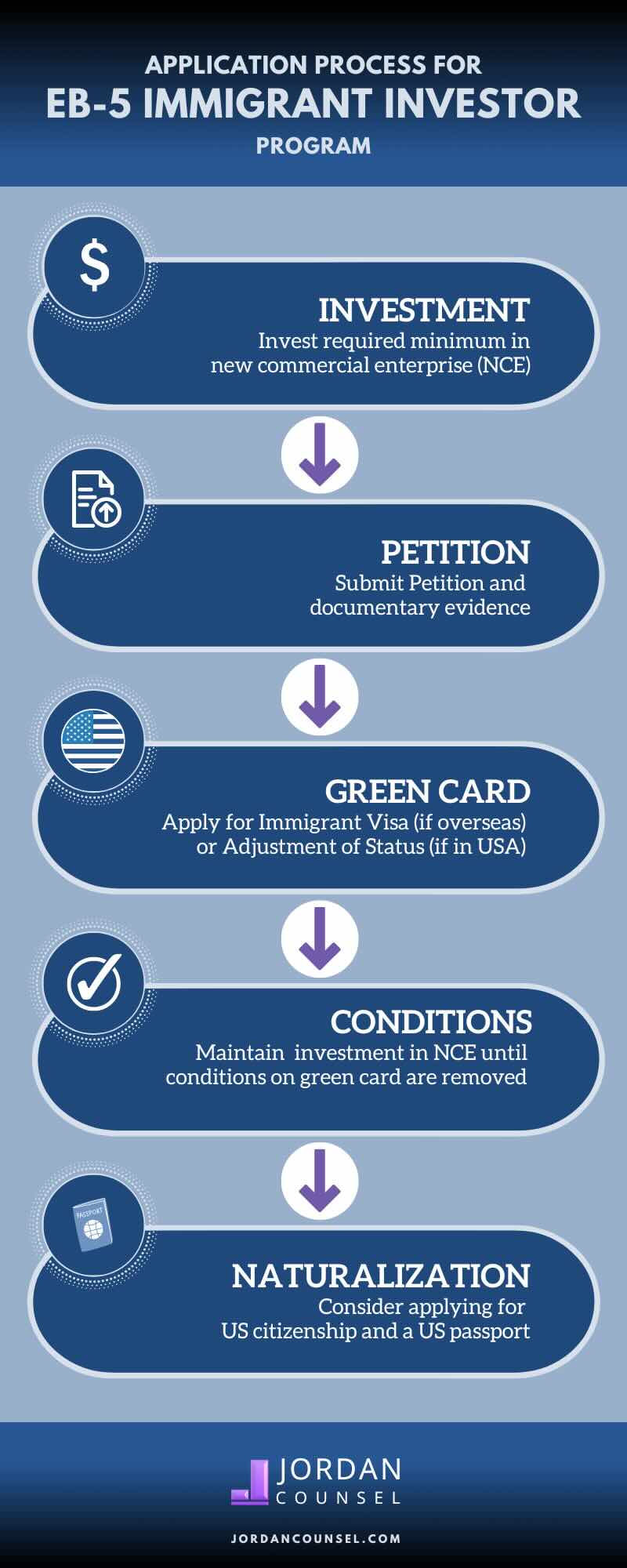

Talk with a Boston immigration attorney about your requirements. Right here are the basic actions to getting an EB-5 financier eco-friendly card: The primary step is to find a qualifying financial investment opportunity. read This can be a brand-new business, a local facility task, or an existing business that will certainly be expanded or restructured.

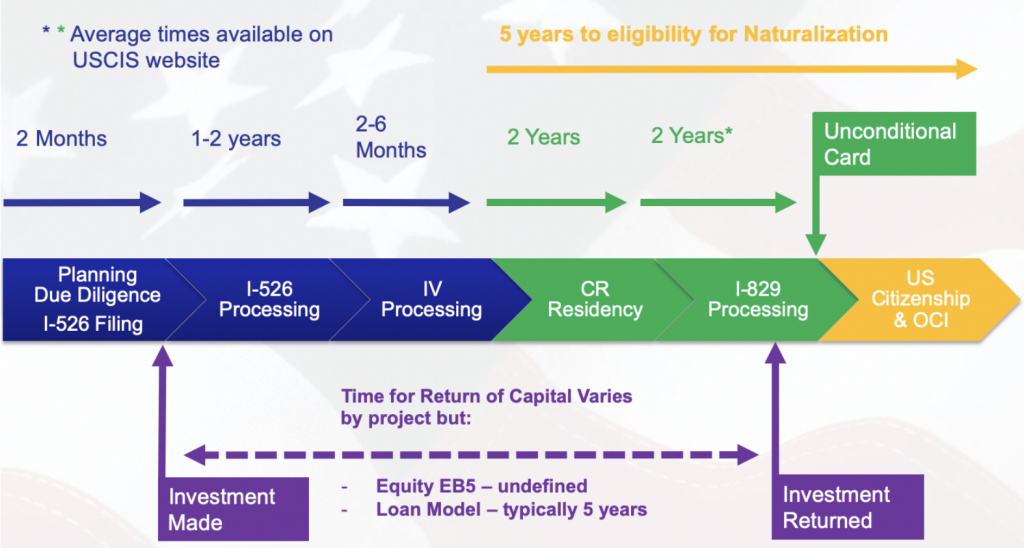

As soon as the opportunity has been recognized, the financier must make the investment and submit an I-526 application to the U.S. Citizenship and Migration Provider (USCIS). This request has to consist of proof of the financial investment, such as bank statements, acquisition contracts, and service strategies. The USCIS will review the view publisher site I-526 application and either authorize it or request additional proof.

Eb5 Investment Immigration for Dummies

The investor needs to obtain conditional residency by submitting an I-485 petition. This application must be sent within six months of the I-526 authorization and should consist of proof that the investment was made and that it has actually created a minimum of 10 full-time tasks for U.S. workers. The USCIS will certainly examine the I-485 application and either approve it or request additional evidence.

Report this page